SmartPricing

Learn more about our incredible SmartPricing feature and how you can customize settings in any automation when sending orders to your broker.

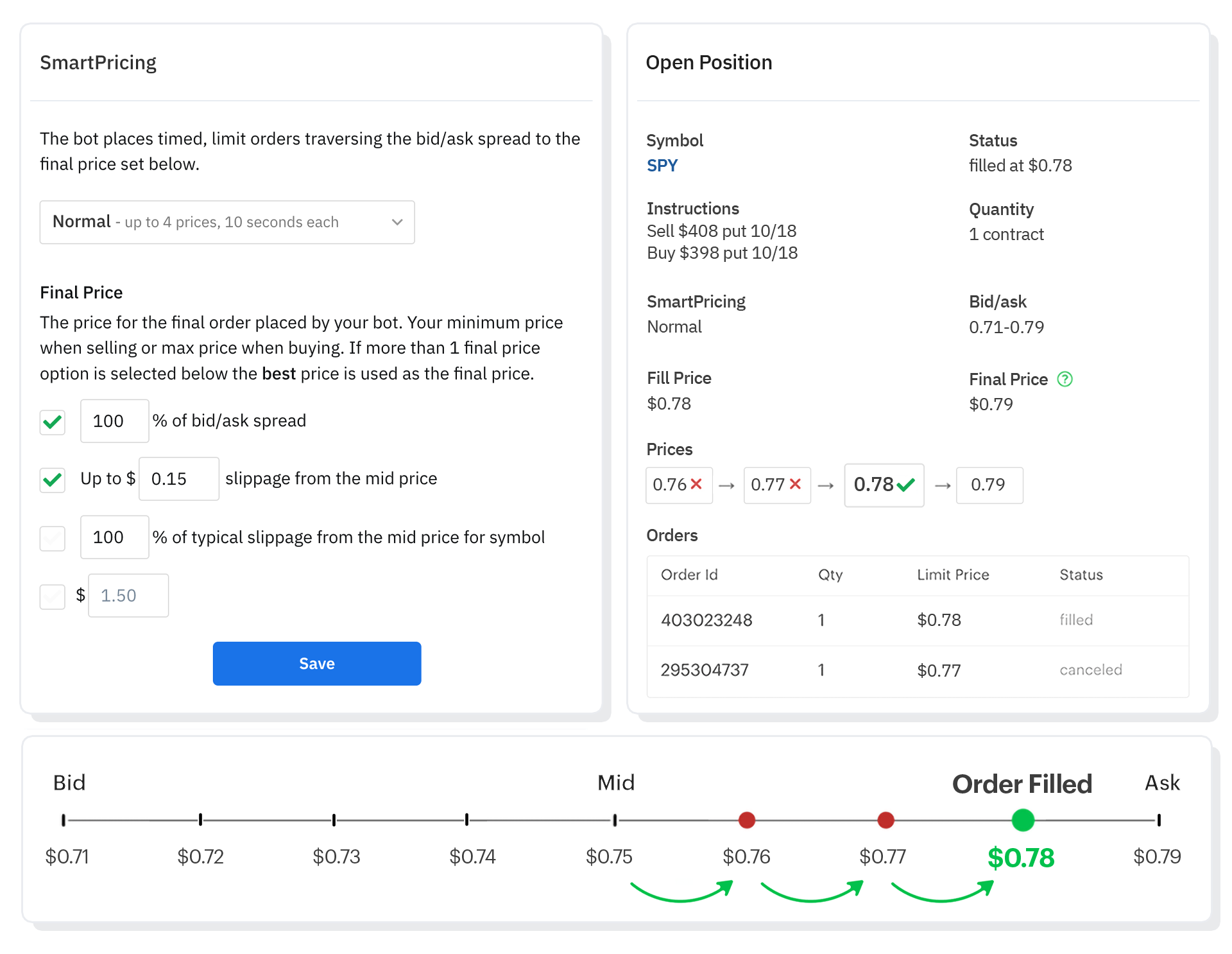

SmartPricing places timed limit orders traversing the bid/ask spread to your final price. SmartPricing starts at the mid-price and works toward the bid when selling or ask when buying.

Each order will stay active at the broker for an amount of time based on the setting selected. Unfilled orders are canceled autoamatically and replaced with the next price in the sequence. The final price will stay active for two minutes and then cancel automatically.

You can choose from three SmartPricing settings (normal, fast, patient), turn SmartPricing off and use a single limit, or send a market order.

Normal will try up to 4 prices, 10 seconds each.

Fast will try up to 3 prices, 5 seconds each.

Patient will try up to 5 prices, 20 seconds each.

Bots do not send resting GTC orders to the broker. Option Alpha operates under a different paradigm. Positions and markets are "watched" by the bots, and if the entry or closing criteria are met, orders are sent to the broker instantly per your SmartPricing and Final Price settings.

Final Price

SmartPricing's Final Price settings allows us to customize the minimum or maximum price we're willing to let the bot to attempt. The final price is the final order your bot will send - your minimum price when selling or max price when buying.

If more than one final price option is selected, the best price is used. If the bid/ask spread is narrow, the best price may be the ask when entering a trade. But we can also use use the slippage from the mid-price setting to protect against price fluctuations. This allows the bot to trade even when bid/ask spreads get wide, while still controlling slippage.

For example, if selecting 100% of the bid/ask and $0.10 from the mid-price, the best available price of the two will be used.

In the image below, the bid/ask spread is $22.30 -$23.00, with a mid-price is $22.65. The bot would have tried a final price of $22.55 ($0.10 from the mid), but did not continue all the way to the bid price of $22.30.

If you select 100% as the final price of the bid-ask spread then SmartPricing goes from 50% (mid) to 100% (ask). If you select 75% as the final price of the bid-ask spread then SmartPricing goes from 50% (mid) to 75% (halfway between the mid and the ask).

If you limit SmartPricing to 50% as the final price of the bid-ask spread it will only attempt the midpoint price because the midpoint is 50% of the distance between the bid and ask by definition.

Bid (0%) - - - (25%) - - - Mid (50%) - - - (75%) - - - Ask (100%)

Keep in mind you're selecting the "final price", not the percentage of the bid-ask spread that's used. SmartPricing always starts at the midprice.

We can also use a math operator as a final price setting inside a 'Close Position' action in automations. The final price value references the position’s opening entry price to arrive at a final limit price to exit the position.

For example:

A x 1.15 multiplier would close the trade with a 15% or better profit for a debit type trade.

A + 2.50 addition would close the trade with $250 or better profit per contract for a debit type trade.

A x 0.50 multiplier would close the trade with a 50% or better profit for a credit type trade.

A - 0.75 offset to the position’s opening price would close the trade with a $75 or better profit per contract for a credit type trade.

SPX SmartPricing

SmartPricing calculates the prices based on several points across the bid/ask spread. For example: mid, 1/3, 2/3, final price.

In the case of SPX, the prices at the fractions in the middle are rounded up or down to the nearest nickel ($0.05) depending on whether you are selling or buying.

For example, if the bot is using the 'normal' SmartPricing setting to open an SPX short put spread with a $0.50 wide bid/ask spread, it will start at or near the mid price and send timed limit orders as it traverses toward the bid as optimal as possible. $0.25 cannot be evenly distributed four ways, so SmartPricing automatically adjusts the spacing of the orders.

SmartPricing automatically rounds to the nearest nickel increment price (rounds up when selling, down when buying). In the above example, he final price is set to $4.23, so the bot rounds up to $4.25 and will not try a price below that.

The fill price is the mid of all legs added together. In the case of SPX which can only fill legs in nickel increments, it can result in a mid that is not actually in the middle of the bid/ask.

For example, an SPX call with a bid/ask of $0.10 - $0.15 the mid price is $0.15 when buying, $0.10 if selling since there is no valid price in between the spread. When you apply that same rule for all legs of a multi-leg position, you can end up with a mid price that is not very intuitive.

SmartPricing example

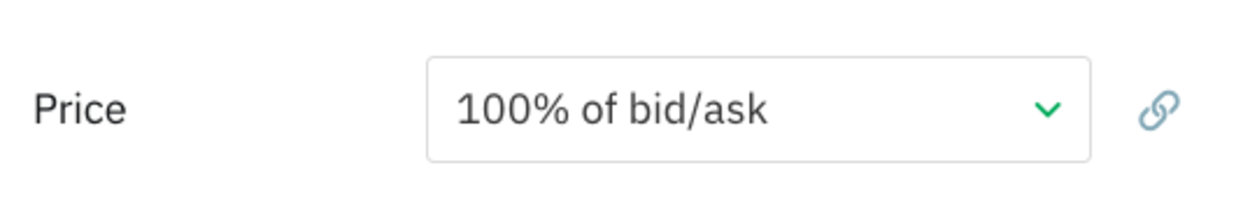

The Final Price setting is available on all position opening actions (e.g. Open Position, Open Trade Idea, etc), the Close Position action and each Exit Option setting. The default is to try filling the trade at a price up to 100% of the bid/ask spread, which looks like this:

In this case the bot will start with an order at the mid price and try up to a total of four different prices before it makes it to the "Final Price", which is set to 100% of the bid/ask spread.

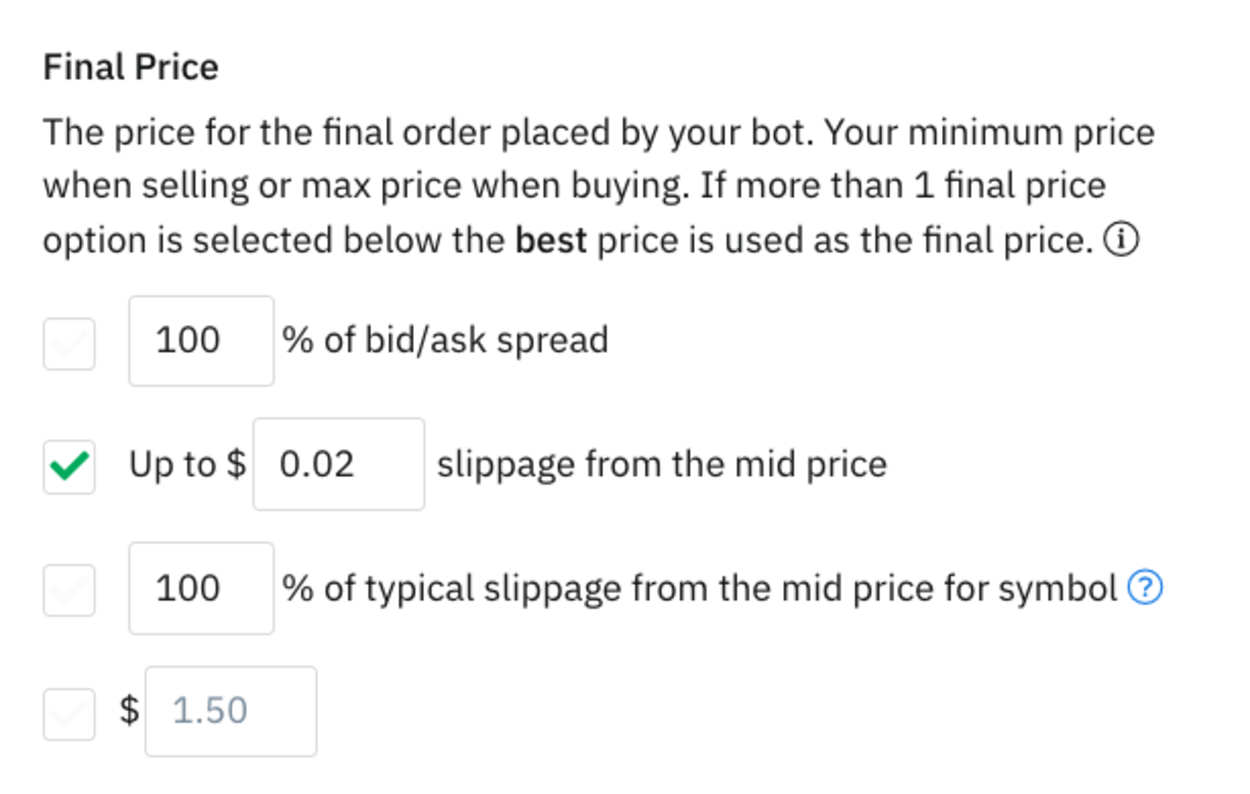

If you click the "Price" field, you have the option to control the "Final Price" the bot will try to get the order filled at, for example:

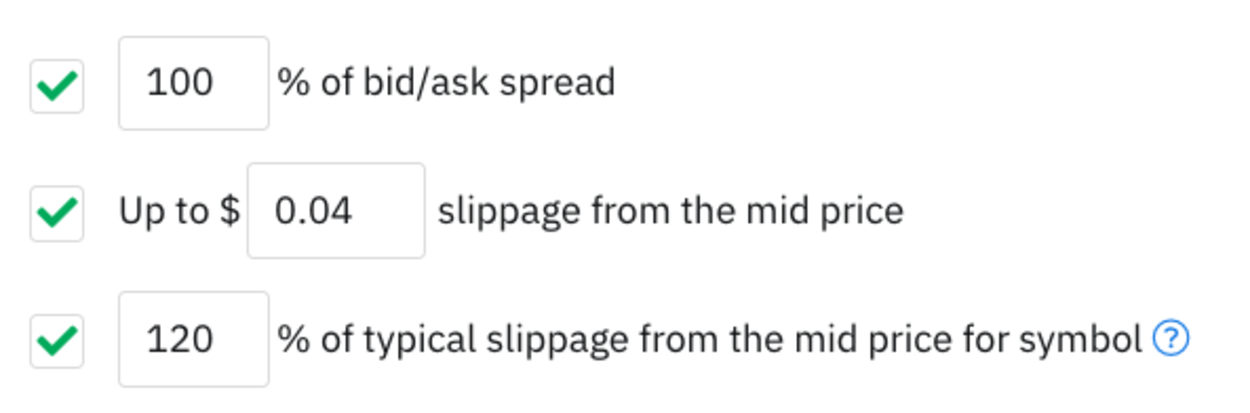

If you select more than 1 Final Price option then the best price is selected as the final price to try to get filled at. For example, you could select:

Which would make it use whichever is the "best" fill price for you out of those 3 options.

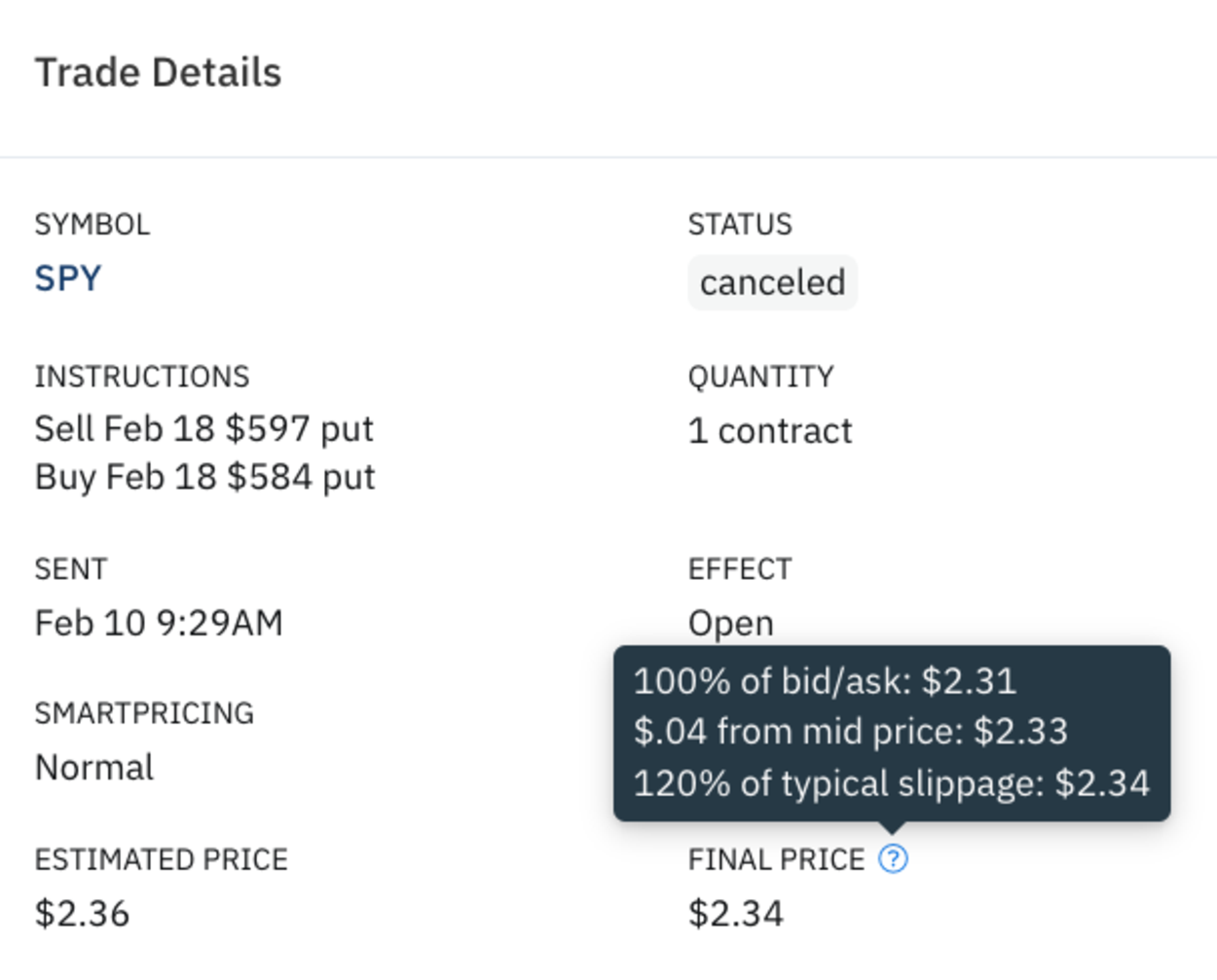

You can see a log of the values at the time of the trade in the trade log here:

This was selling a short put credit spread, so the "best" price of the 3 selected options was $2.34 from the "120% of typical slippage" option and that was used as the Final Price to try to get filled at.

Last updated

Was this helpful?