Autotrading Best Practices

Here is what you need to know as you plan your trading bots from start to finish.

Following the best practices discussed in this article, such as paper trading, understanding live fills, thorough bot comprehension, organization, and preparation, can significantly improve your chances of successful autotrading. By adopting these practices and remaining disciplined in your approach, you can navigate the markets more confidently and effectively with Option Alpha's autotrading platform.

Here are the "Do’s and Don’ts" for successful autotrading at Option Alpha:

Do’s

Think through your bot's logic from entry to exit

The main challenge in automated trading is thoroughly considering the entire trading process. Traditionally, traders could make changes dynamically; but with autotrading, the entire process must be planned from entry to exit. Automation involves creating a structured plan for the bot, essentially turning your trade strategy into decision-based instructions.

Before building your bot, you should meticulously design your trading strategy, map out each decision point, and outline the trade process. You can then translate this strategy into an automation using if/then statements.

Key factors to consider include asset type, capital allocation, trading frequency, market stance, evaluation criteria, indicators, and exit plans. Think about the big picture of the bot and narrow down your objective:

Do you want to trade stocks, ETFs, or options?

How much of your total capital do you want to allocate?

How many positions do you want to enter daily? Total?

Are you bullish, bearish, or neutral on the underlying asset?

What market criteria do you want to evaluate?

What kind of indicators do you use?

When and why do you plan to exit the trade?

Once the framework is ready, you can use the automation editor to execute the bot's actions.

It's best to test automations and paper trade the bot before using real funds to ensure it meets your expectations. Ultimately, as a trader, you're responsible for designing the trade plan and instructing the bot accordingly.

Paper trade before going live

Before deploying your bots in live trading, it is crucial to test your strategies in a risk-free environment using the in-app paper trading account. Paper trading allows you to simulate real market conditions that can help observe and refine your strategy. We suggest paper trading for a minimum of 30-60 days before risking any live capital.

Paper trading your bot allows you to answer key questions about the bot's functionality:

Did the framework you created do what you expected?

Did the bot enter the positions you anticipated?

Did your closing actions exit positions according to your plan?

Test the same way you expect to go live

If you are starting out with $10K of capital and will begin trading with one contract, then you should calibrate your paper bots to use the same allocation and position size. This ensures that your expectations and behavior will not vary drastically when shifting to live trading.

Adjust live pricing expectations

It's important to recognize that live fills are not guaranteed and that the symbols and strategy you choose to trade can affect the difference in results between live and paper trading. The favorable fill prices provided by paper trading engines may differ from live market executions. Be prepared for slight variations and adjust your expectations accordingly.

Get comfortable with how the bot works

Before going live with your bot, you should be comfortable with the logic and actions you are using. Familiarize yourself with the indicators, triggers, and logic employed by your bot. Read the bot logs to fully understand when and why trades are opening or closing. Observing your bot’s activity will give you a complete understanding of how it operates and will enable you to make informed decisions to optimize your bot's performance effectively.

Utilize bot notes and titling

Stay organized by utilizing the bot notes section to document your observations and any adjustments made to the bot's settings. Additionally, give your bots unique icons and descriptive titles to identify their purposes and strategies easily.

Familiarize yourself with broker rejection errors

Prepare for potential broker rejection errors by understanding their causes and implications. Always utilize the Entry and Position criteria and the Pattern Day Trading (PDT) check inside Exit Options to mitigate some common errors and issues.

Understand option expiration & assignment

Bots have certain limitations you should be aware of. For example, bots do not know if an option is assigned. We suggest you have a detailed understanding of the option expiration protocol and adjust your account's position management settings accordingly.

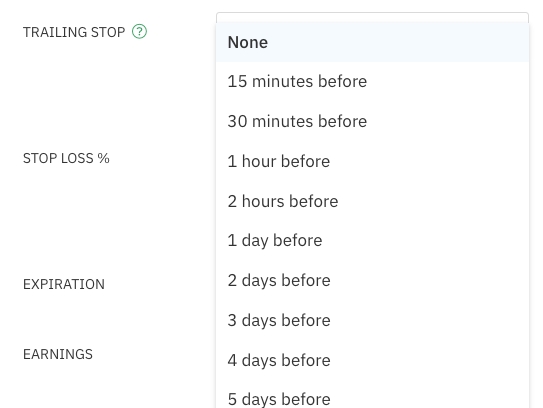

Typically, in-the-money options have a higher chance on or near expiration day. Expiring trades, specifically short-term and 0DTE positions, should be managed accordingly. Option Alpha's Exit Options have safeguards for exiting position's on expiration day to manage assignment risk. Remember, assignment is random and unpredictable.

As always, we recommend talking to your broker about specific position handling near expiration. Some brokers may choose to automatically close positions prior to the end of the trading day. Also note that out-of-the-money options can still be exercised after-hours. Learn more about options settlement.

Use a Guard to Protect Trailing Stops from Wide Bid/Ask Spreads

Volatile markets can lead to erratic pricing and wide bid/ask spreads. You can use a bid/ask guard to automatically disable Exit Options and ignore position returns until pricing becomes more rational. If the bid/ask spread is larger than your acceptable price, Exit Options won’t send an order. It also won’t record the position’s high or low.

Don’ts

Blindly clone bots from the community and run live

It's tempting to want to trade live as soon as possible and especially after encountering bots made by others in the community that show signs of success. However, we suggest you always paper trade and understand all of the bot's components before risking your own capital; regardless of the author or shared results. Bots are simply decision logic that has been combined into a set of instructions to form a strategy. The name, the author, and the recent results are all secondary components to this underlying truth. You, as the trader, need to determine if that strategy is right for you, and we encourage everyone to interview bots and make sure they’re worthy of trading your hard-earned cash.

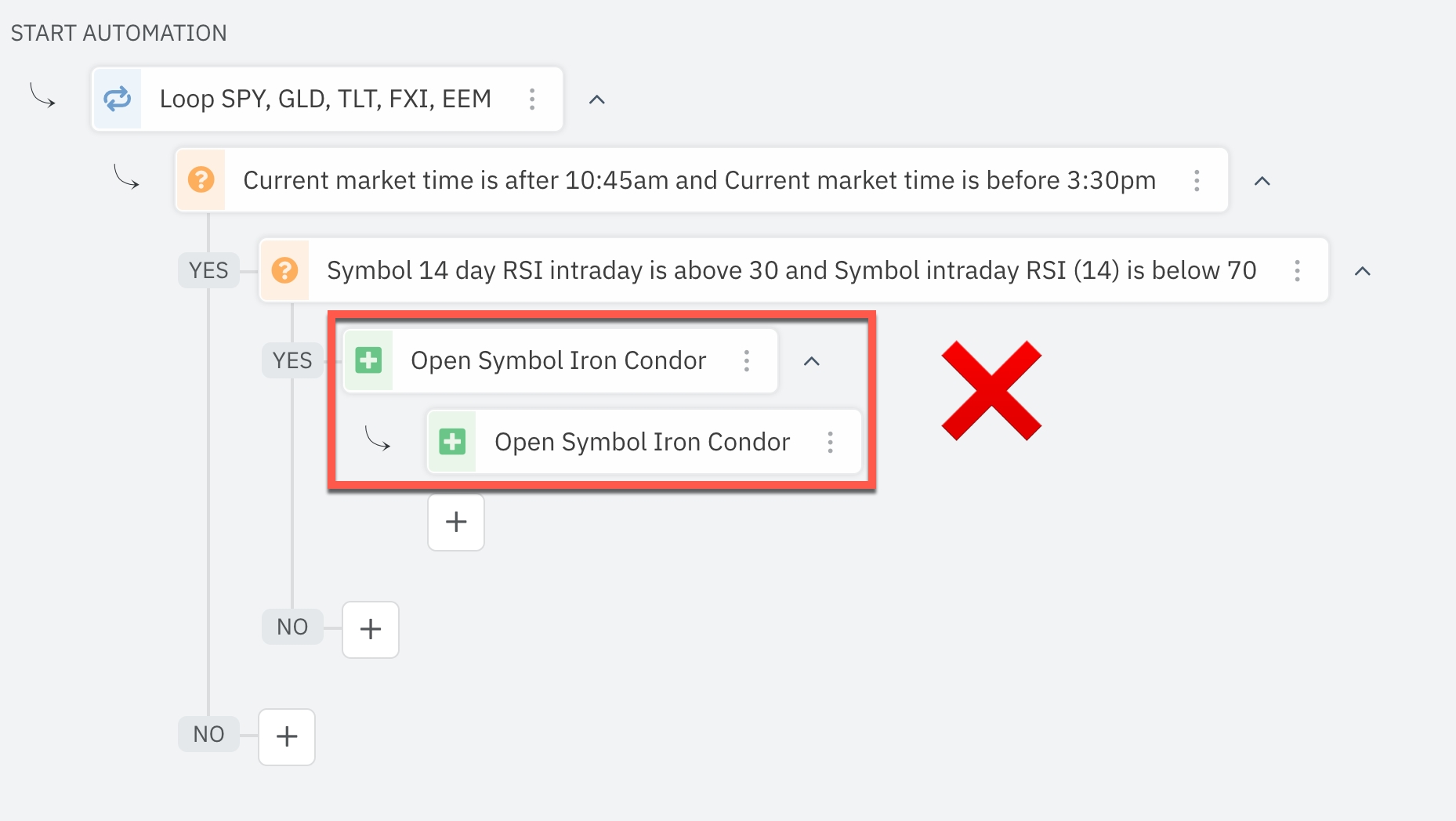

Stack multiple Open Position actions

Running multiple open position actions, one after another, can lead to undesirable outcomes. Because there are no guarantees either order will be filled, it's important to utilize an event trigger when scheduling automations for your secondary entries and ensure that positions are opening in a more orderly sequence.

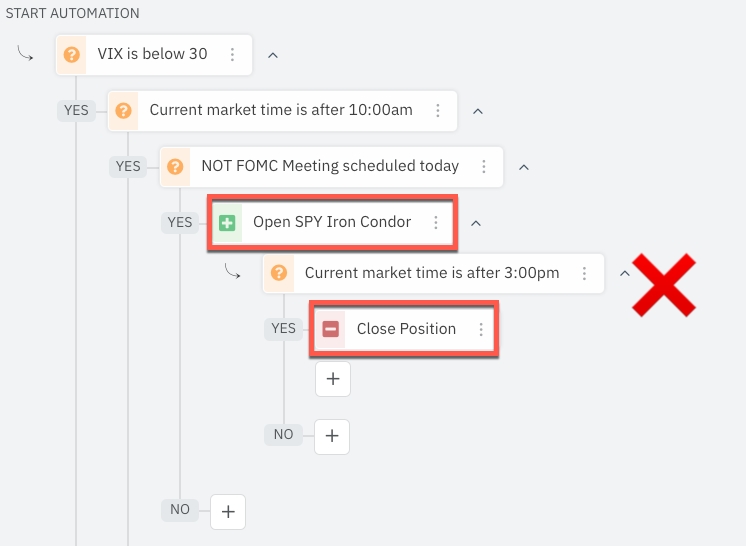

Simultaneously use Open and Close actions in the same automation

Similar to stacking multiple open actions, you should avoid combining Open and Closing actions in the same automation path. When an order is sent to the broker for execution, the bot state changes, and the order is essentially detached temporarily from the bot until the order is returned with updated details. When combining Open and Closing actions, you will run into situations where the ‘Position’ is unknown to the bot and an error will be generated.

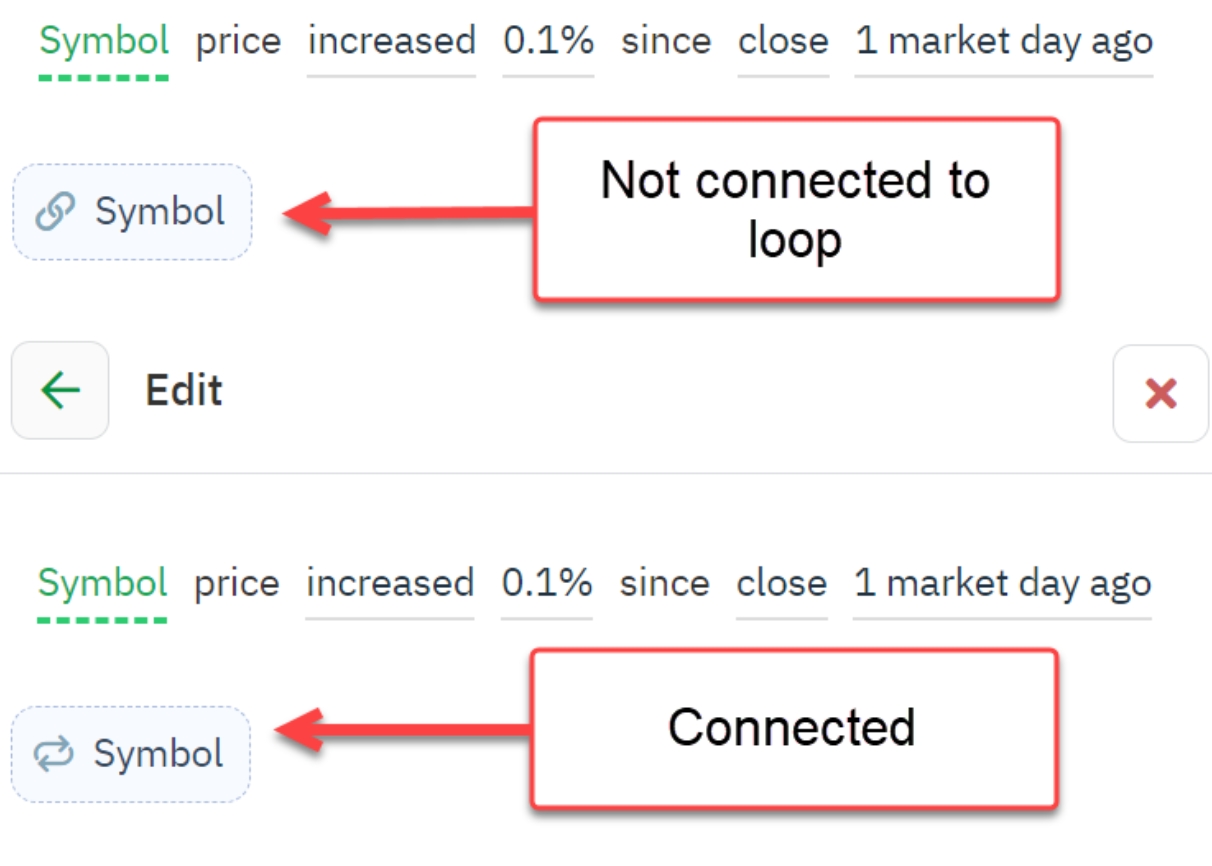

Create duplicate ‘Symbol’ or ‘Position’ inputs

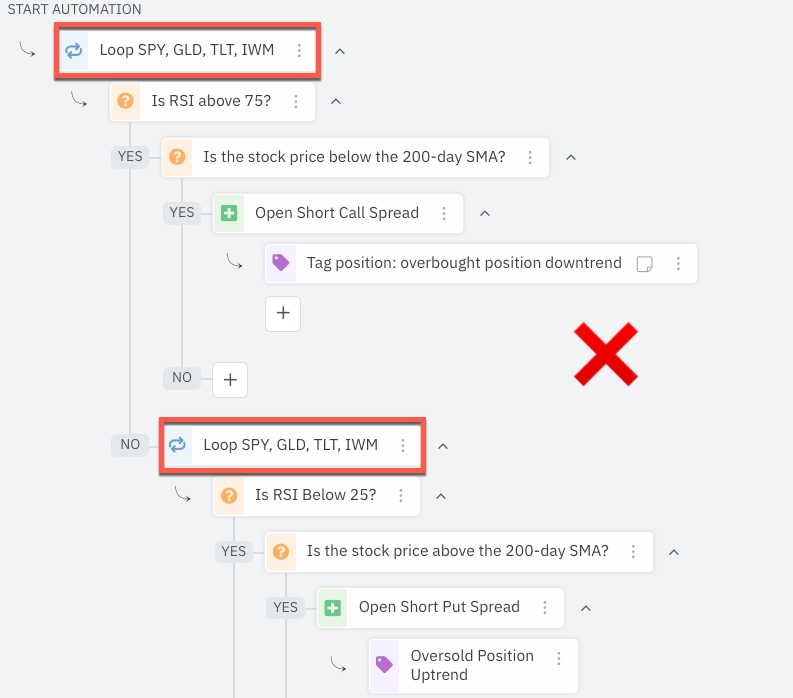

Instead, use the default symbol or position inputs supplied by the Loop. If you start the automation with a Loop, all subsequent decisions that require referencing a symbol or position will be linked automatically to that Loop and will display the infinity icon vs. the chain link.

Use more than one Loop

It's best to start each automation with a symbol Loop in scanner automations or position loops in monitor automations. Adding additional loops at different sections of the automation can lead to mixed-up inputs and generate errors.

Trading the exact same strategy in multiple bots

Running multiple instances of the exact same bot when trading live can potentially create issues with your broker. The broker often perceives entry and exits in the same positions are manipulative behavior and will flag your account accordingly. Stick to a single instance for each bot unless there are differences in their trade details.

Ignore your brokerage account

Remember, automated does not mean unattended. We strongly recommend that you continue to check your broker account, positions, and order activity on a regular basis. Bots are not aware of early assignment, so your Option Alpha autotrading account will not reflect any change to positions that did not occur within the platform. We also suggest you speak directly to your broker about their position management and associated fees so you're aware of their procedures.

Last updated

Was this helpful?