Decision Calculations

Overview of the calculations used by decision recipes to determine position value.

Rate of Return Calculation

Assume a credit spread where strike width = $2.00 and credit = $0.50, then

Max profit = 0.5

Max risk = 2.00 - 0.5 = 1.5

Rate of return = 0.5 / 1.5 = 33%% Premium Calculation

let {openPrice, markClose} = position;

let change = markClose - openPrice;

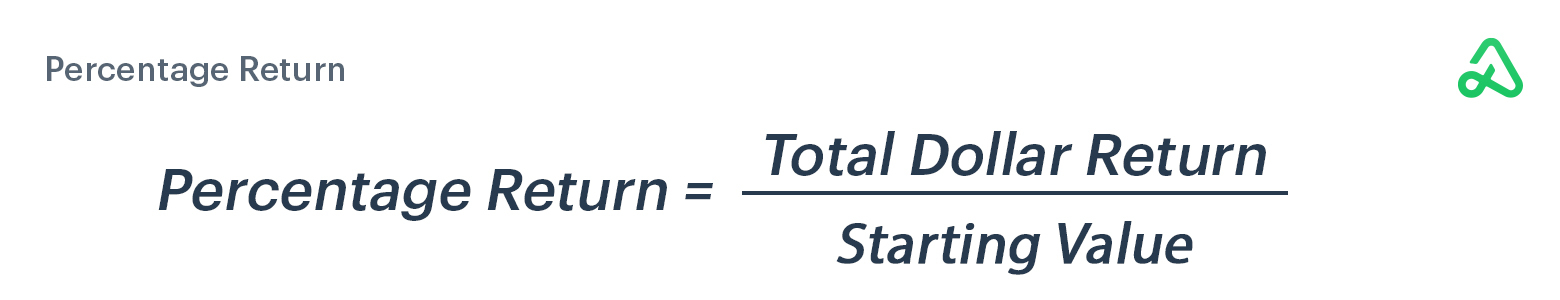

let changePct = change / openPrice * 100;Return % Calculation

Total P/L

Total P/L %

Day P/L

Day P/L %

Closed P/L

Win Rate

Last updated

Was this helpful?