Testing Automations

Testing automations enables you to check all the logic and decision criteria to be confident your bots will perform how you anticipate.

Testing your bots and automations is a critical step when building your portfolio. Testing allows you to observe how your bot works, diagnose potential issues, and ensure that automations function as you intend.

There are multiple ways to test your bots. We recommend running bots in a paper trading account before using live capital.

We encourage you to continuously test all facets of a bot to feel confident your strategies execute correctly. It is important to test in multiple environments, capital structures, and trading limits.

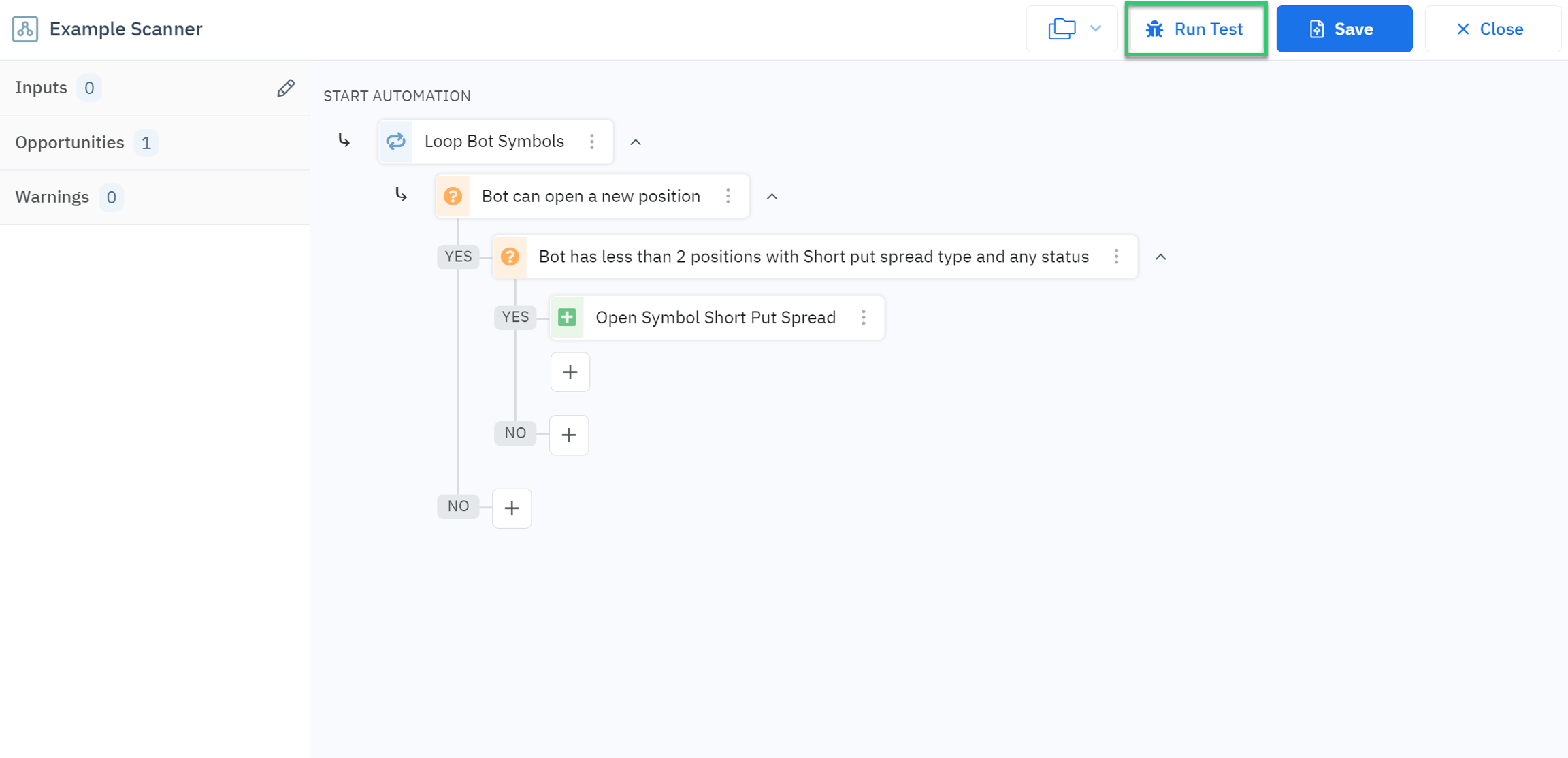

You can always test any automation type individually by clicking the “Run Test” button.

The test feature allows you to verify the automation’s logic will function the way you expect it to and identify where any issues may occur.

You can choose any bot to run the test in and even assign custom inputs. Testing an automation in different bots lets you view the results for additional capital allocations and position limits.

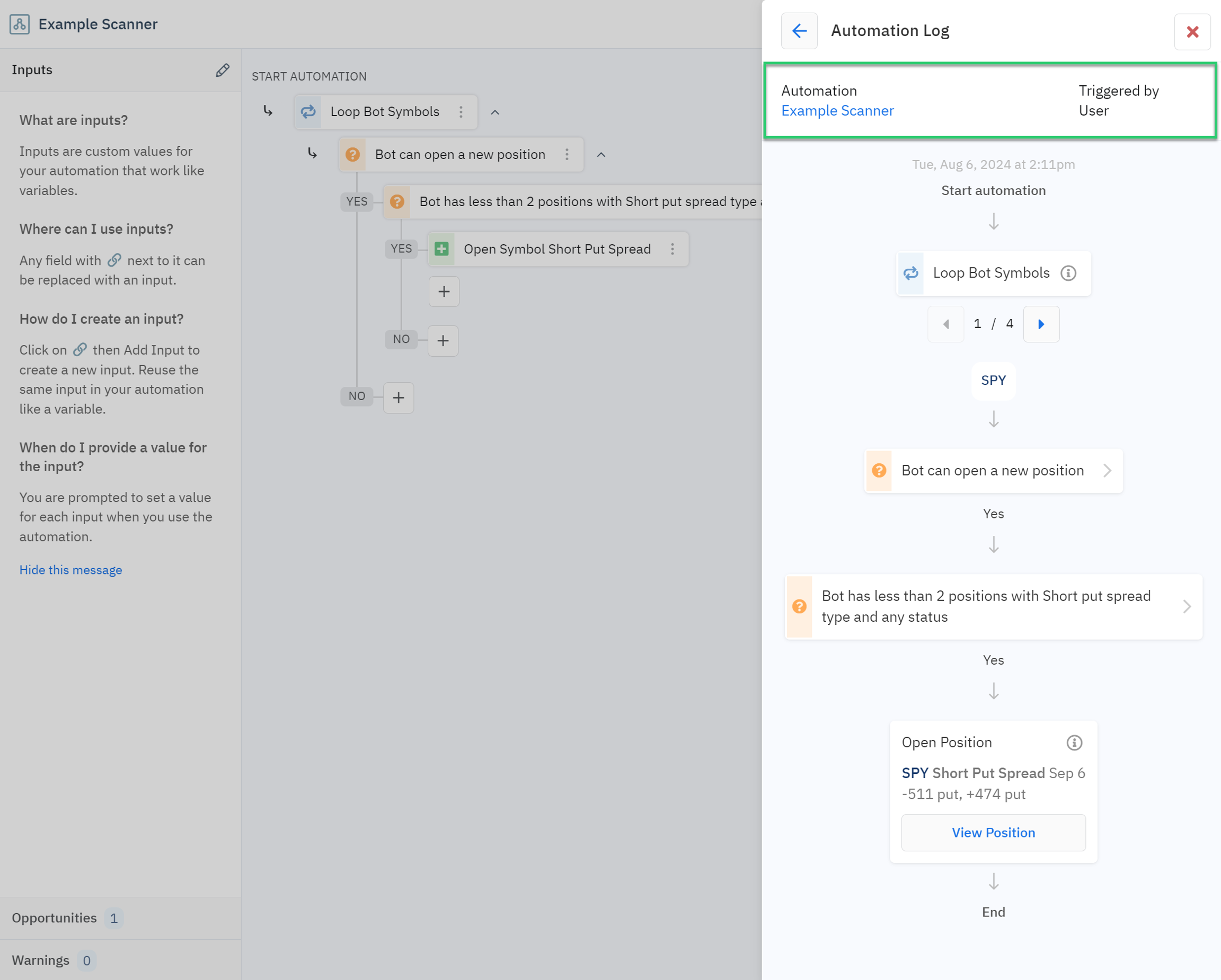

When testing an automation, live market data is used when evaluating decision recipes. You can view all information immediately in the Automation Log.

Testing your bots is also a proactive way to review how different variables affect the bot. For example, changing a technical indicator may determine whether or not a position will be opened or closed at the end of the automation.

Remember, this is only running a test inside the bot. Positions will not be opened, and no actions will be visible in the Bot Log. Testing is a great way to verify your bot’s decision-making parameters and outcomes.

Last updated

Was this helpful?