Bot Limitations

Learn the current limitations of the autotrading platform and how to navigate certain situations that are out of the bot's control.

Account Restrictions

Any restrictions placed on an account by the brokerage can only be restricted by that brokerage. Restrictions include EM Restrictions (Pattern Day Trader), Good Faith Violation, and Free Riding violation. Please note that all restrictions are imposed by the brokerage, not the Bot Platform, and need to be reconciled with the brokerage.

Margin Calls

Bots have no knowledge of account type. They only know an allocation amount. All Reg-T requirements and maintenance calls for equity positions bought on margin should be managed through the brokerage platform.

Exceeding Maximum Risk

Bot capital allocation limits are calculated at position entry. Market conditions at position closing may cause increased capital allocations beyond the calculated maximum risk at position entry. If the market is illiquid or bid-ask spreads are wide, bots have the potential to risk more capital at position exit than was allocated at position entry.

For example, if there is a wide bid-ask spread for a credit spread position, the ask price to close the spread may exceed the spread’s width. This is not solely a function of the bots. It is common for a credit spread to move against the trader and display P/L numbers beyond their max loss throughout the course of the trade. Therefore, it is best to consider max risk as the maximum risk at expiration.

As always, you have the ability to manually override positions, SmartPricing settings, exit criteria, and orders at any time. If you manually override a position, the Option Alpha platform no longer communicates with the position, and the position will not count against position limits or capital allocation limits. You may need to re-consider your bot’s capital allocation limit if you manually override positions.

More info on risk at expiration can be found under 'Forced Closures' in Order Handling.

Earnings Changes

Company earnings dates can fluctuate and change on a regular basis for a variety of reasons. It is also common for the time of release to shift from AM and PM. The trader should remain aware of this at all times if they intended to use bots to trade earnings and manually intervene if necessary.

We currently do not provide a solution to differentiate between AM or PM earnings releases.

Ticker Changes

Occasionally, corporations change their ticker symbol. Ticker symbol changes affect options chains and all identifiers for a security.

Bots do not automatically update or change to a newly issued ticker in the event of a ticker change. Traders should be aware of all corporate actions that could cause a ticker change to occur for any of the stocks or ETFs they're trading. Please reference the OCC website to review and maintain up-to-date information on any changes that would affect the symbols used within the bots.

Stock Splits & Corporate Actions

Stock splits, reverse splits, stock dividends, spin-offs, mergers, special dividends, buyouts, and ticker symbol changes create unique situations for autotrading.

Stock splits, reverse splits, and stock dividends* change the number of shares in a position.

Stock splits and stock dividends* increase the number of shares in a position. Reverse splits decrease the number of shares in a position.

For example, a two-for-one stock split would double the number of shares outstanding and give every shareholder two shares for every share owned while reducing each share’s value by half.

*Stock dividends, as opposed to cash dividends, are paid to shareholders in additional shares rather than cash.

Spin-offs, mergers, special dividends, and buyouts may impact the cost basis for positions, impact the options chain identifier, define a different deliverable for the options contract, or a combination of those impacts.

Bots manage positions based on the quantity and underlying option symbol at the time the position was opened. Changes in the position’s characteristics (such as the number of shares or symbol) after the position was opened are outside the scope of the bot’s management visibility.

Upon closing, the bot will attempt to close the entire position as it was opened, so the bot is unaware of symbol or quantity changes and unable to successfully close positions affected by these corporate actions.

If your bot is managing a security that announces a stock split, reverse split, stock dividend, spin-off, merger, special dividend, buyout, or ticker symbol change, the appropriate action is to manually override the position.

Manual override enables you to release a position from the bot’s management or manually close a position through your broker’s platform (not in the Option Alpha platform). The position would no longer exist in the Option Alpha platform, so this is a great tool to take back management of a position.

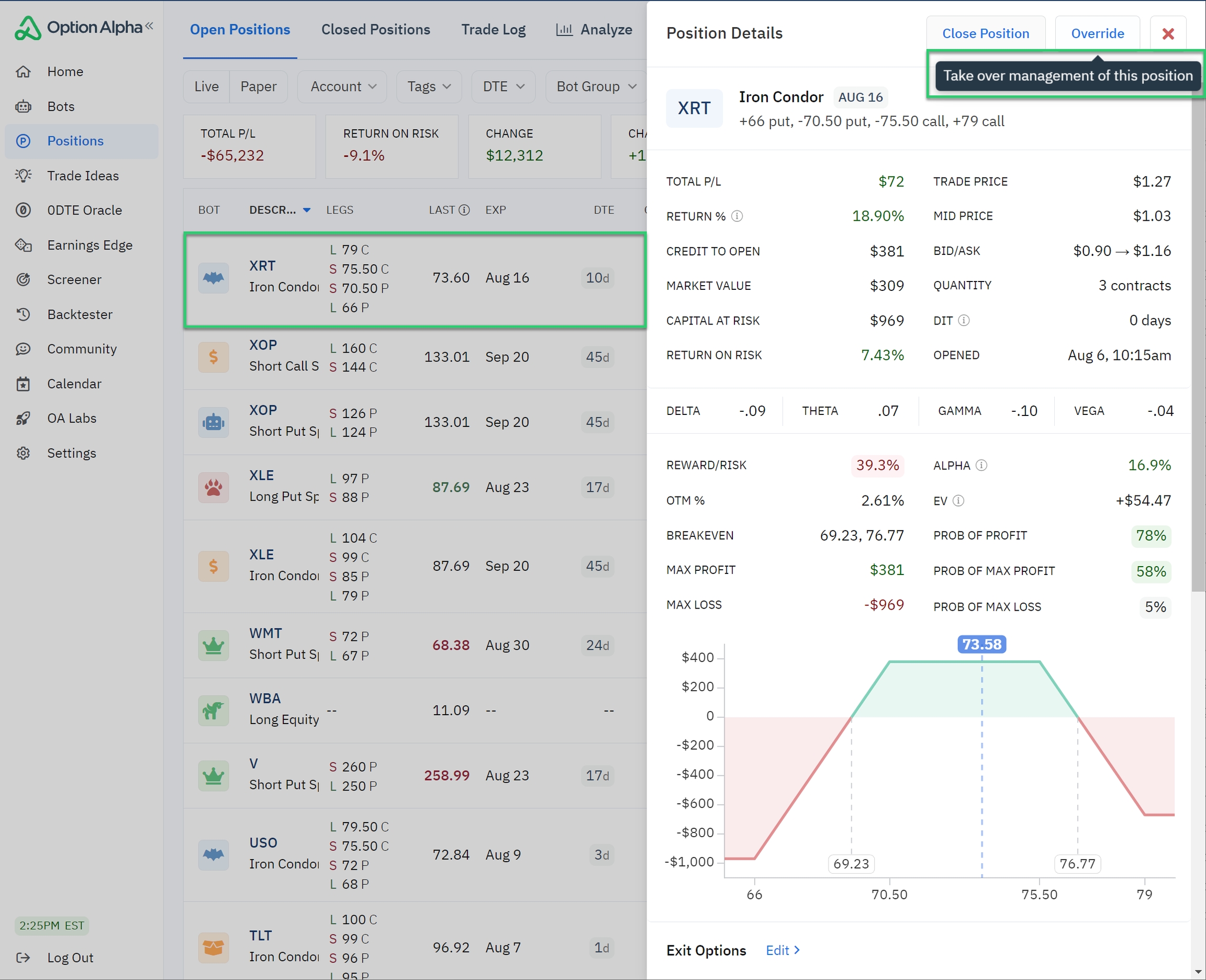

To override an open position, choose a position and select “Override” in the Position Details.

Overriding a position disconnects the position from the bot and transfers it to your broker platform for manual management. If you manually override a position, the Option Alpha platform no longer communicates with the position, and the position will not count against position limits or capital allocation limits.

Overriding a position does not automatically close a position. The position remains open in your brokerage account, and you are responsible for the position’s management.

The position’s original details are still available. Any actions performed manually after the position has been overridden, such as closing orders and final P/L, are not visible in the bot.

If you have a bot that scans for new position opportunities in a security with these corporate actions, you may either turn off the bot or remove scanners with the affected symbol.

When automations are off, they no longer run at their scheduled interval. Any open positions inside the bot will remain open but will no longer be managed by the bot. You can turn automations on or off at any time.

Remember, automated does not mean unattended. An essential part of autotrading is to pay careful attention to the tickers you trade so that you are not adversely affected by corporate actions.

Last updated

Was this helpful?