Understanding Alpha and Expected Value

Explore the math behind Expected Value (EV) for defined-risk options trades. We discuss Trade Ideas 2.0's groundbreaking EV-based Alpha metric.

Expected Value (EV) is a fundamental concept in probability theory that provides insight into the outcome or value of a random variable. To put it simply, EV is a weighted average of all possible outcomes. It serves as a powerful tool for decision-making and risk assessment.

In options trading, calculating the EV of a trade is useful for evaluating its potential profitability. To accurately calculate the expected value for an options trade, we found it critical to assess the probabilities and associated payoffs not just for a single profit/loss scenario, but for every profit/loss scenario.

We’re excited to announce that in Trade Ideas 2.0, we’ve completely revised the Alpha metric to be based on the true Expected Value of an Opportunity. It is a calculation that no one else in this industry is offering.

To understand how and why, let's explore three levels of increasing difficulty for calculating the expected value of a risk-defined options trade, accompanied by mathematical examples for each step.

A model is only as good as its assumptions. For the following examples, we assume all trades are defined-risk, meaning both the maximum profit and loss are known. We also assume there is an efficient function for calculating the probability of the underlying’s price being above or below some price in the future; for this, we will be using the Probability Density Function (PDF) described by Black-Scholes. Learn more about how Option Alpha calculates probabilities here.

Calculating EV at Expiration for Max Profit or Loss

The simplest and most often cited method of calculating EV is for maximum profit and loss at expiration. This method is often described using hypothetical scenarios like, “Would you play the game?” E.g., if you won $1 for every coin flip that landed heads and lost $2 for every coin flip that landed tails, would you play the game?

Simple Betting Games

The options trading analog is to assume that for every “play” of the game (trade taken to expiration), is it worth it to play assuming you took full profit or full loss?

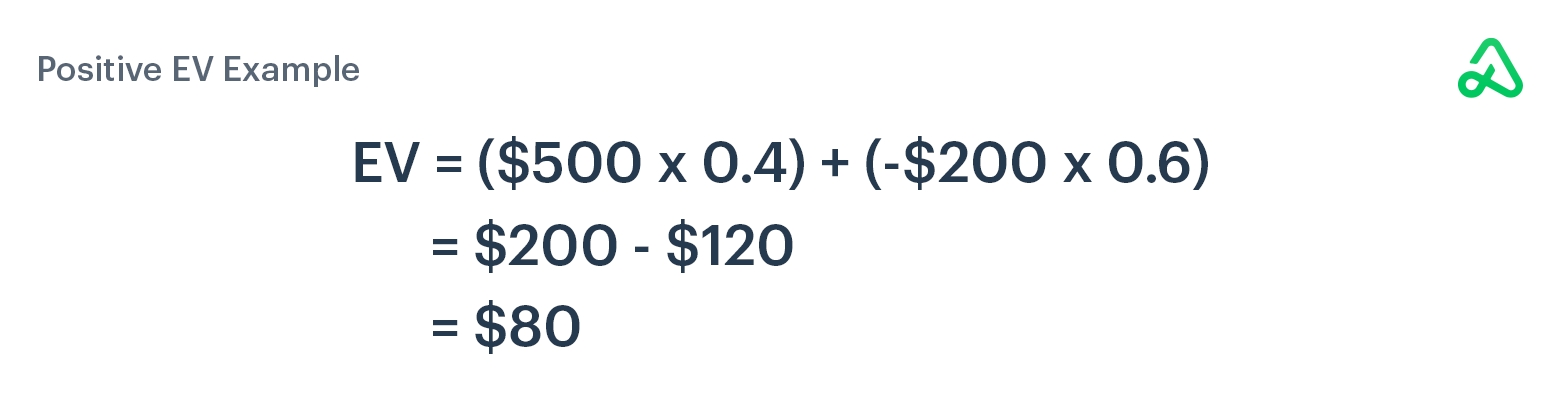

Consider a betting game with a maximum potential profit of $500 and a maximum potential loss of $200. Suppose you estimate the probabilities of reaching the max profit and max loss at expiration to be 40% and 60%, respectively. To calculate simple EV, you multiply each outcome by its probability, P(x), and add them:

Therefore, the expected value of an options trade at expiration, considering only the max profit or max loss scenarios, is $80.

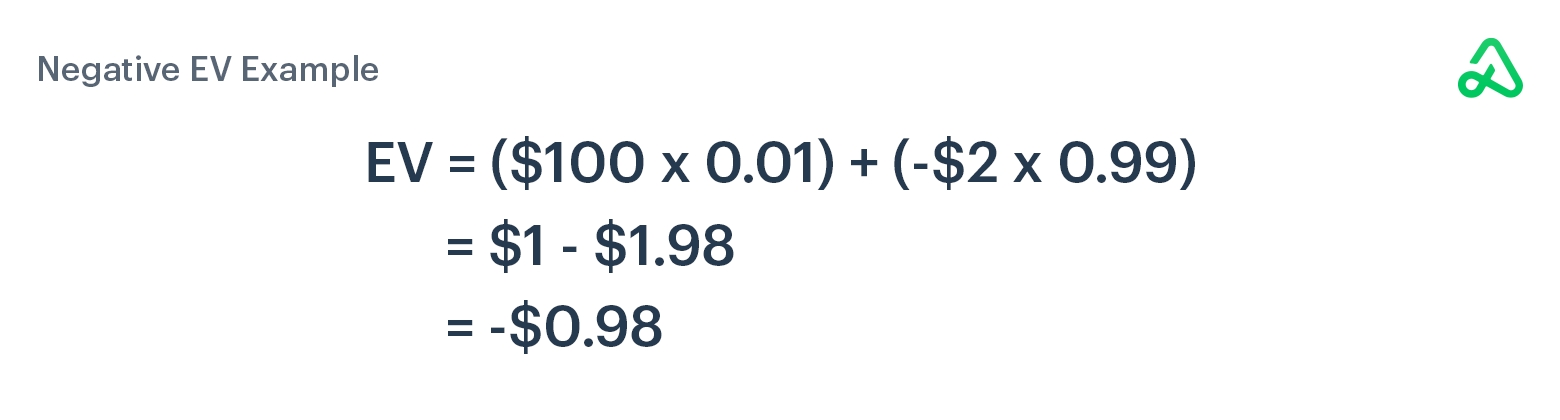

The expected value is not always positive, however. More often than not, EV for betting games is negative when there’s a lower percentage chance of winning a lot of money and a higher percentage chance of losing a little money, e.g., playing the lottery.

Imagine a lottery game where you bet $2 with a 1% chance of winning $100 and a 99% chance of losing $2.

So, over time, you can expect to lose $0.98 every time you play the game.

The problem with this calculation, however, is that options trades are not strictly binary outcomes, and the assumptions used here will usually yield an EV of near zero when real market payoffs and probabilities are used. But there is a gray area beyond the short strikes and before the breakevens where some, but not all, profit can be achieved. This can wildly affect the outcome over many occurrences.

Example:

To illustrate, let’s first consider the simplest case where the third possibility, the “gray area,” results in a fixed payout win, rather than a difficult-to-calculate partial win or loss.

Estimating Expected Value for an Average Outcome

If EV is just the summation of probabilities multiplied by their outcomes, then it stands to reason that the more probabilities and outcomes known, the more accurate the final value will be.

Any time you see options EV quoted or explained in a defined-risk manner where the probabilities sum to 1 while only considering the max profit or loss, you can immediately assume that it’s wrong. At best, it’s a broad estimate or generalization.

The probabilities of max profit and loss can’t sum to 1 because there is a very real possibility the underlying asset's price is between the strike prices at expiration. In this case, we need to calculate the partial profit or loss.

To address this scenario in an options trade, we can enhance our simple EV calculation by assuming an intermediate payout outcome. This method is commonly employed in some financial software products because it offers a more robust solution while remaining a fast and deterministic calculation for a computer.

The profit is determined by the difference between the net credit received and the difference between the strike prices, multiplied by the probability of the underlying price expiring between the strikes.

The loss is the difference between the net credit received and the difference between the strike prices, multiplied by the complementary probability.

For partial profit/loss, let's first consider the following example of a put credit spread:

Short Put: Strike price $55 Long Put: Strike price $50 Premium received: $2.00

Assuming a 70% probability of the stock price staying above $55, a 20% probability of it expiring between $55 and $50, and a 10% probability of it falling below $50, we can calculate the expected value by using a linear approximation for the underlying price within the range between the two strikes.

Here's a simple way to represent the partial profit/loss EV:

1. Calculate the Range Value: The difference between the short put strike and the long put strike: $55−$50=$5.

2. Calculate the Net Credit Received: Given as $2.00 in our example.

3. Calculate Max Loss: The max loss is the difference between the range value and the net credit received, i.e., ($5−$2)=−$3

4. Calculate Partial Profit or Loss: The expected value of the partial profit/loss is the midpoint between the max profit and max loss, multiplied by the probability of the partial range:

5. Calculate the EV:

Therefore, the expected value of this short put spread, accounting for estimated partial profit or loss, is $1.00.

This approach offers a reasonable approximation without introducing complexity and can be considered a more balanced estimate of the partial profit range payoff within the given probabilities and constraints. It treats the partial range as a uniform distribution and considers the average of the max profit and max loss to represent this range.

Even though this calculation is objectively better than the “simple” method, it’s still just a broad estimate of EV. Since our goal is to be as accurate as possible, we need something better.

Calculating Expected Value as a Random Variable

For Trade Ideas 2.0, we decided to use the most mathematically robust representation of Expected Value that we could. The method we employ and its use in an Alpha metric is, to our knowledge, something not seen anywhere else in the industry.

We’re about to dive into some math theory, so buckle up. What we’re trying to accomplish is known as calculating the expected value of a random variable. But there are different methods of solving this problem, and their use is dictated by how the variable is described: continuous or discrete.

Discrete random variables are countably finite, meaning there is an observable number of increments or steps the value of the variable can be.

Continuous random variables are uncountably infinite.

Continuous Random Variables

A continuous random variable encompasses all real values within a specific range or interval. For instance, it could represent the height of a person or the time required for an event to occur. These are considered continuous because a more granular level of measurement resolution can always be achieved, e.g., a person’s height can always be measured to more decimal places.

Calculating the expected value for continuous random variables involves finding the integral of the product of the variable and its probability density function (PDF) over its entire range.

To determine the expected value, E(X), of a continuous random variable X, the following formula is used:

Here, f(x) represents the Probability Density Function (PDF) of X. By integrating the product of x and its probability density across the range, we arrive at the expected value.

Discrete Random Variables

On the other hand, a discrete random variable takes on distinct and specific values. Examples include the number of heads obtained in coin flips or the outcome of a roulette game. In this case, the expected value is calculated by summing the product of every possible value and its corresponding probability.

The formula for calculating the expected value, E(X), of a discrete random variable X is:

Here, x represents each possible value of X, and P(X=x) denotes the probability of X taking on that specific value. Recall from your college Calculus class that big sigma, ∑, means summation. By summing the product of each possible value and its probability, we determine the expected value.

This is basically a more formal definition of what we were doing in the previous examples, all of which happen to have discrete outcomes.

Underlying Price as a Discrete Random Variable

In options trading, determining EV involves discrete steps due to the incremental nature of potential profits or losses. For example, there are discrete $0.01 steps in the underlying’s price (in most cases) between the upper and lower profit bounds. This means we need to calculate EV based on a discrete random variable, and fortunately, the math to do so is significantly less complicated than continuous variables.

The trade-off, and the reason no one else is doing this at scale, is the higher computational power required to do the summation, which can only be solved at best in linear time. In other words, there are no shortcuts; every discrete outcome and its probability must be calculated within the profit range. The wider the strikes, the larger the profit range, and the more possible discrete outcomes. Multiply that process by millions of Trade Ideas and Opportunities and suddenly you have a big data problem.

To illustrate what we’re talking about, suppose you establish a put credit spread with a short strike price of $50 and a long strike price of $49. The credit spread involves selling an option with a higher strike price and simultaneously buying an option with a lower strike price. The potential payoff at expiration is determined by the underlying asset's price movement relative to the strike prices, and a maximum loss is incurred if the underlying is below the long strike price at expiration. Partial profit (or less than max loss), however, can occur anywhere between the strikes.

To calculate the expected value, we must determine the probabilities and payoffs for each $0.01 discrete increment between $49 and $50. Let's assume the following probabilities are known:

Probability of stock price above $50 (max profit): P(X>$50)

Probability of stock price below $49 (max loss): P(X<$49)

Probability of stock price at each $0.01 increment between $49 and $50 (partial profit):

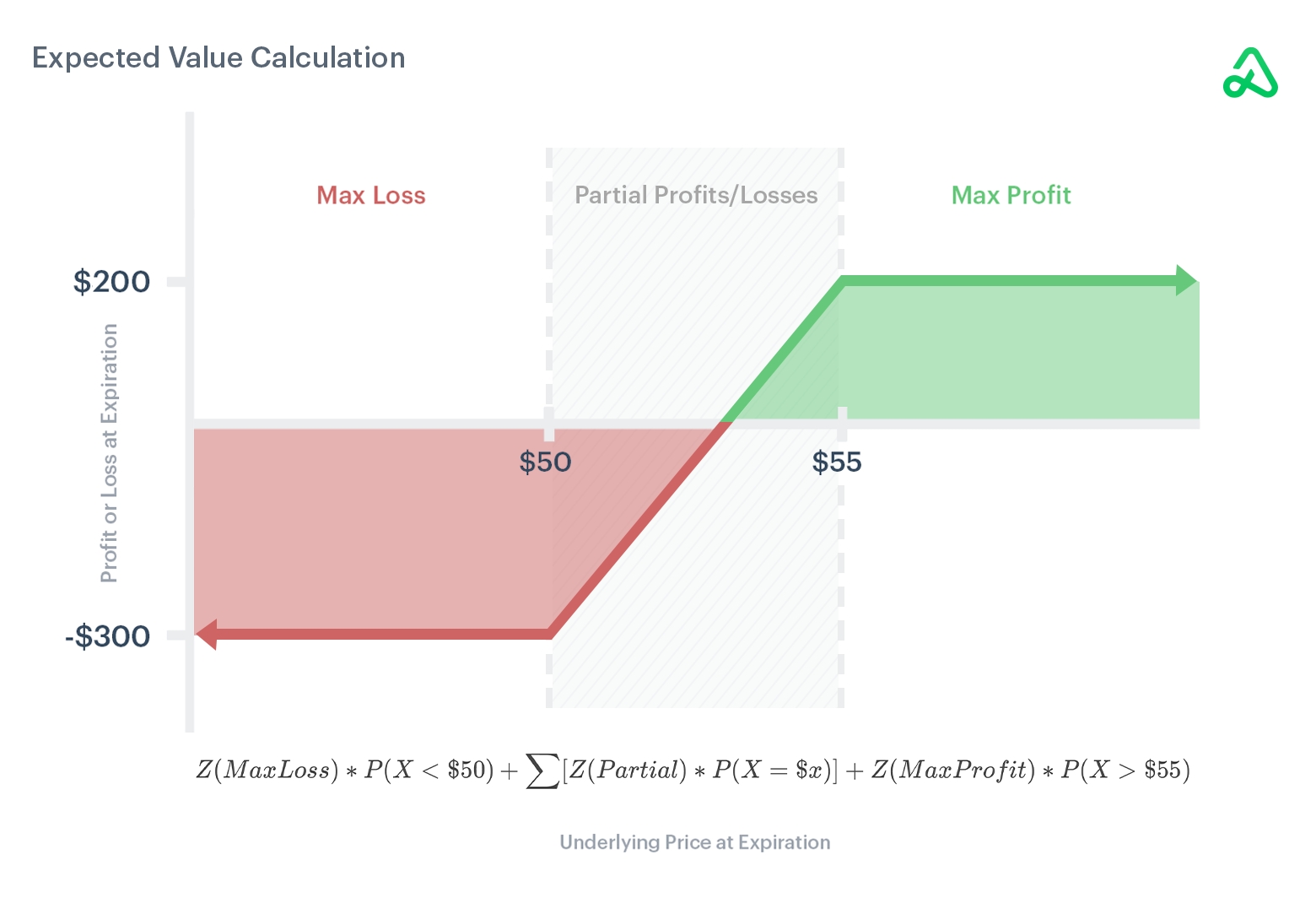

Next, we need to calculate the payout for each outcome. Assume there is a function Z(x) that describes the payout for each outcome x. Now we can multiply each outcome by its corresponding probability, and finally sum the products to create the Expected Value. Our EV equation then becomes:

For outcomes less than $49, the payout is the maximum loss. For outcomes greater than $50, the payout is the maximum profit. And for discrete outcomes between $49 and $50, the payout is a partial profit or loss described by Z(x).

The final equation for calculating the expected value, E(X), in this scenario, can be expressed as:

While on its own a single calculation of this formula can be completed fairly easily using commodity computing hardware, nothing is easy at scale. In order to build and rank Trade Ideas, we are computing EV along with many other performance probability metrics for millions of trade setup combinations.

This requires us to rent some truly powerful cloud computing hardware each month. But we chose to do it because we believe this equation provides the most accurate and useful expected value metric available anywhere. That is what Option Alpha traders deserve and it gives us great pride to be able to provide it for you.

The New Alpha

In Trade Ideas 1.0 we created the notion of Alpha, which was a proprietary value that combined various market metrics and statistics in a unique way to provide a score that identified trading opportunities.

But that Alpha didn’t sit right with us. We want to be in the business of transparency, not opacity, and we don’t want to peddle the illusion that we know something OA traders don’t, or that we’re smarter. We’re not. We’re just traders who use and share the tools we build because we believe there’s a better way to trade options.

In Trade Ideas 2.0, we decided to revise how Alpha is calculated and share it with you all in a completely transparent and reproducible way. Now that the true EV of a trade is known, we simply calculate the Alpha value as the Expected Value divided by the Max Loss - an enhanced version of the Reward/Risk metric.

We have published multiple Research Insights blogs to analyze how pre-trade EV and Alpha values compare to realized P/L results using Trade Ideas positions.

Conclusion

Understanding and calculating the Expected Value in options trading is essential for assessing the potential profitability of a trade.

In this article, we walked through three increasing levels of difficulty for calculating EV, and described how traders can delve into increasingly complex calculations involving probabilities, payoffs, and discrete price increments. The resulting Expected Value provides valuable insights into the average outcome of an options trade.

In Trade Ideas 2.0, we introduced the most robust and computationally heavy calculation for EV to provide traders with the most accurate calculations in the industry, something not seen anywhere else.

Last updated

Was this helpful?