Options Expiration Protocol

Managing Expiring ITM Positions in Option Alpha

Option Alpha uses protocols for expiring positions based on their moneyness.

Positions expiring in-the-money are subject to assignment and/or broker intervention based on the contract type and your account balance.

By default, the bot will calculate the estimated P/L from the underlying's closing price at the end of expiration day. The bot WILL NOT send an order to close the position. Live positions expiring in-the-money are subject to assignment/exercise by your broker.

In your Settings, you can select how you want your bots to handle expiring In-the-Money positions at expiration:

Calculate estimated P/L from underlying close price (Default)

Close position with a market order

Override position and manually enter results

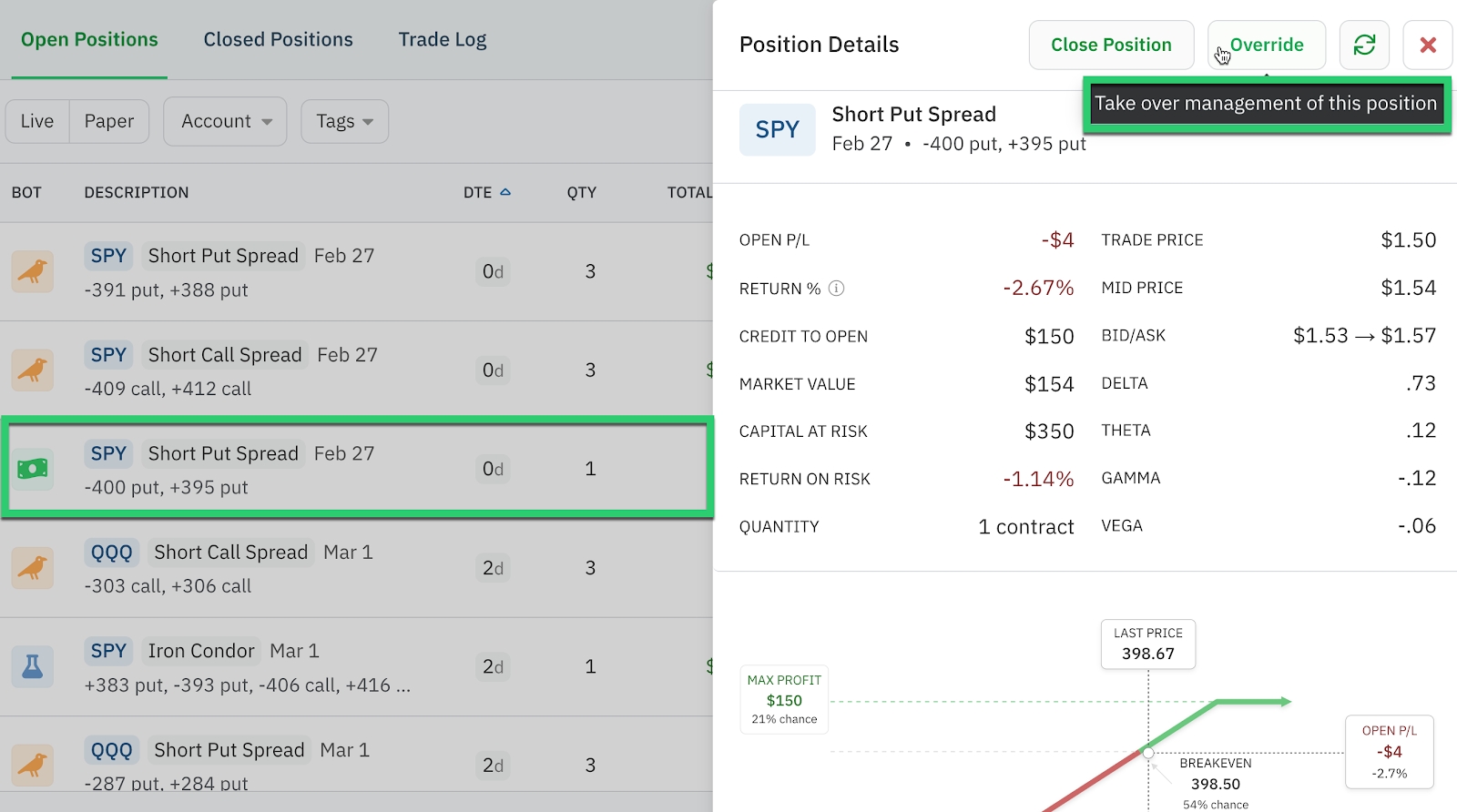

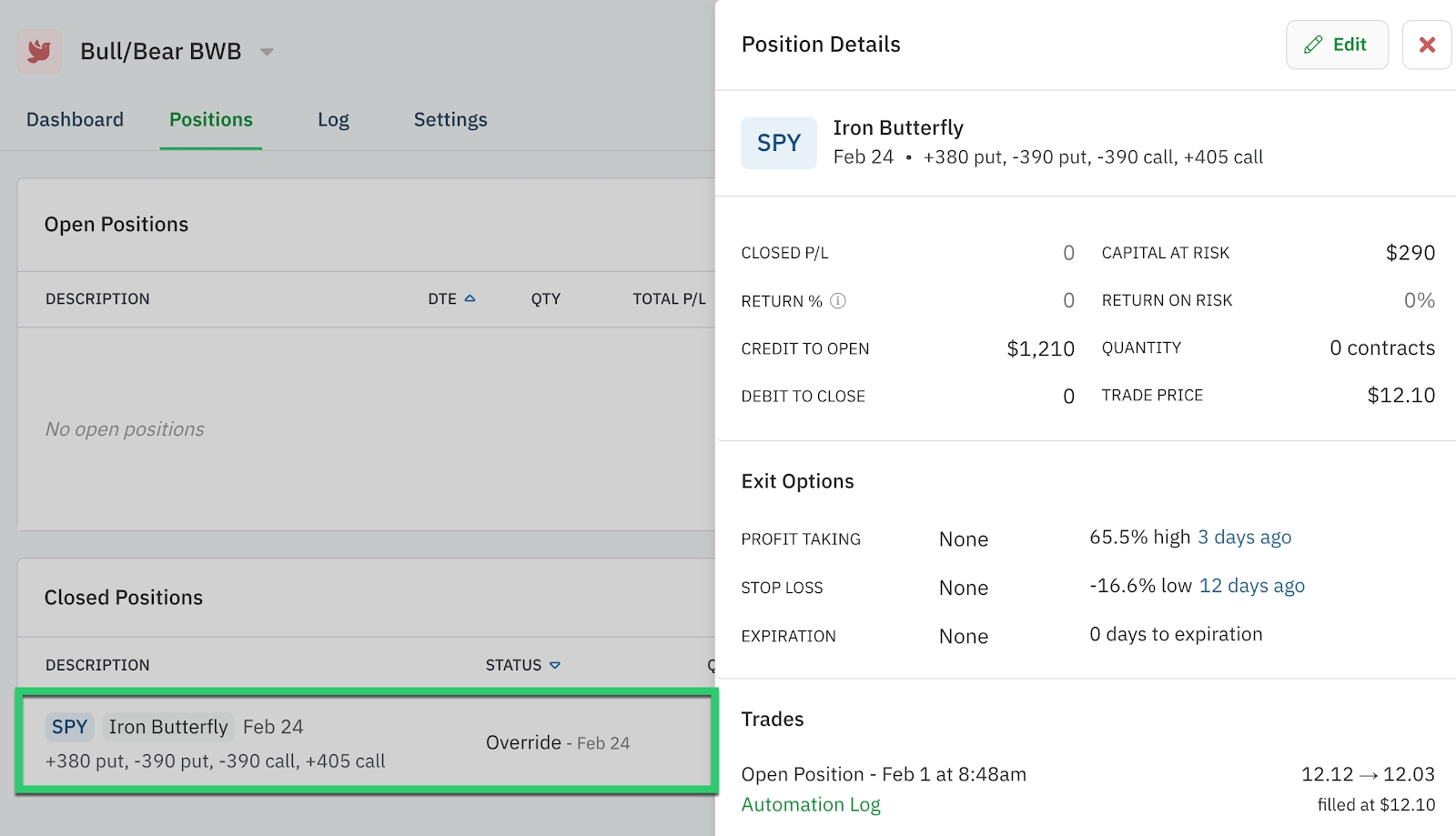

Positions that have been overridden are no longer managed by the bot. It is the trader's sole responsibility to manage their positions and update the ending value. We recommend checking with your broker to confirm their expiration day position handling.

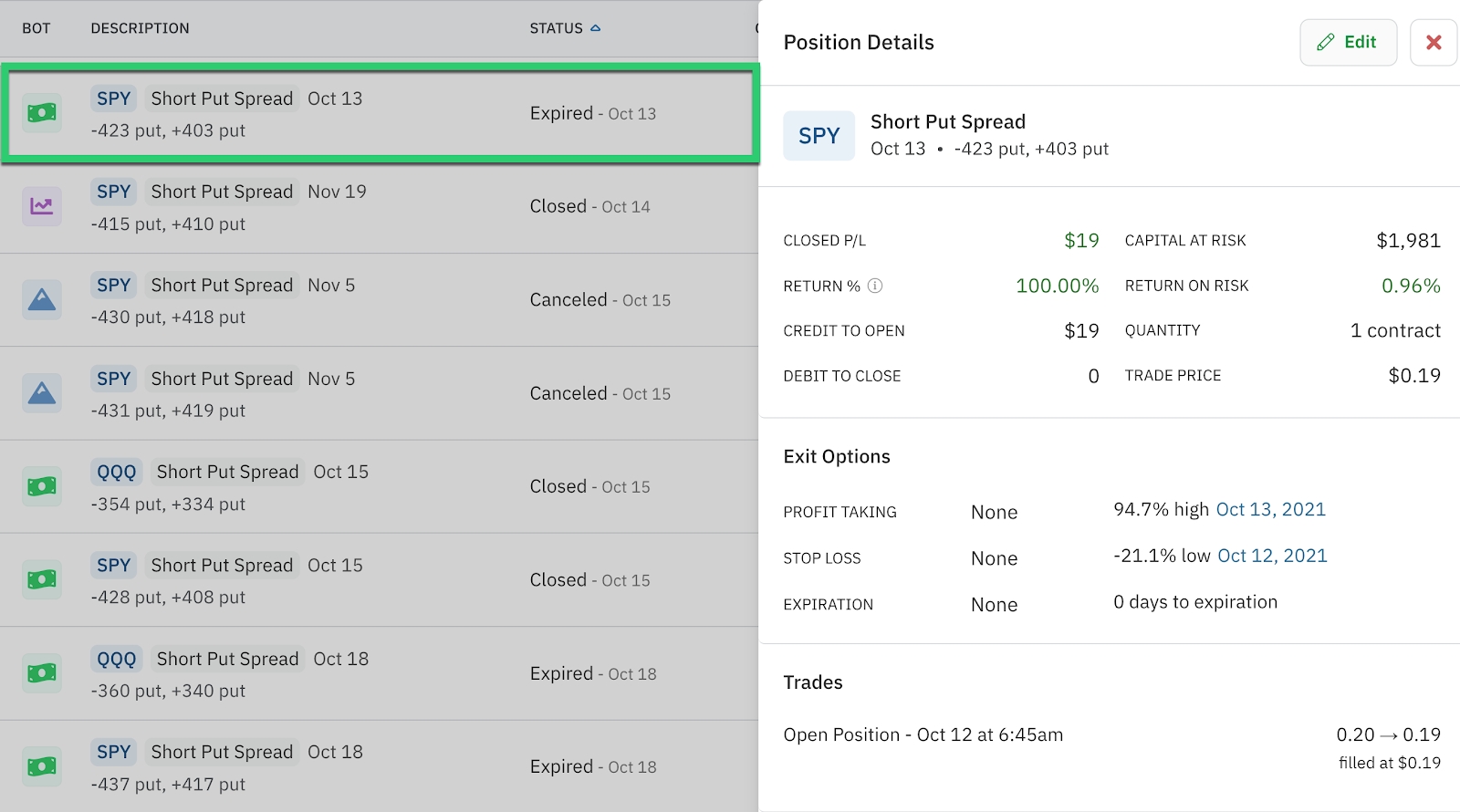

Option Alpha does not close option positions that are Out-of-the-Money (OTM) on expiration day. Contracts that expire OTM are worthless and you will realize the full loss for long positions or the full profit for short positions. Option Alpha last checks a position's moneyness 10 minutes before the market closes. Note that options are eligible for assignment after-hours.

It is the trader's sole responsibility to update the ending value of their position using the Position Editing function and to ensure the bot's performance accurately reflects the outcome of expired positions released due to being In-the-Money.

Generally, early closure rules depend on whether the account has the funds to cover an assignment, whether the position is ITM, OTM, or ATM, and the account type where the expiring position is held. Check with your broker for more information.

If you want to take assignment of an expiring position, you must manually override the position to transfer management from the bot. If you select 'Override position and manually enter results' in your Settings, the bot will automatically override the position at 3:50 pm EST.

You can see positions you override under the bot's 'Closed Positions.'

It is important you understand the options expiration protocol of both Option Alpha and your broker and take the necessary steps to avoid or accept assignment of options positions.

The autotrading platform submits a buy-to-close (BTC) or sell-to-close (STC) order and lets the broker perform reconciliation if the order is valid.

The broker reconciles a buy-to-close or sell-to-close order against existing positions. Buy-to-close (BTC) or sell-to-close (STC) orders do not automatically reverse if the position does not exist (go long or short instead). Instead, the orders will generate an error message.

If the autotrading platform attempts to close a position that has been assigned, the bot will receive an error message for the closing order, and no action will be taken.

Last updated

Was this helpful?